IRF Study: Continued Growth for Gift Cards, Merchandise and Experiences in 2025

This recently published survey supports the insights of over two dozen executives at leading businesses and organizations in the field in recent RRN market reports contacted before its publication.

This recently published survey supports the insights of over two dozen executives at leading businesses and organizations in the field in recent RRN market reports contacted before its publication.Click here for EEA sponsors; here to subscribe, and here for an RRN media kit.

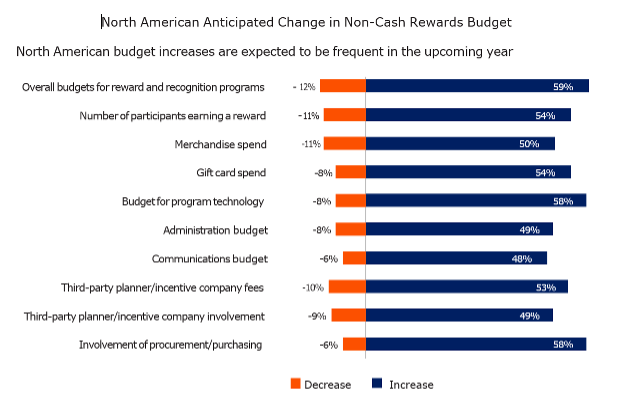

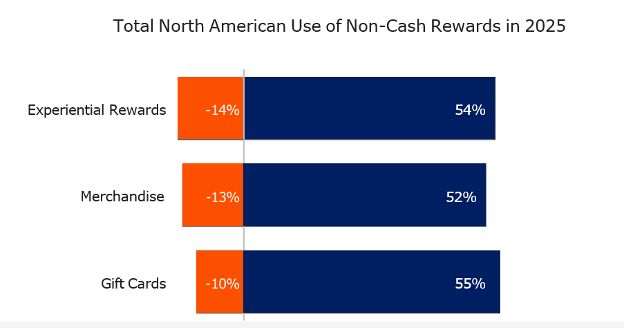

Looking ahead to 2025, budget expectations for non-cash reward programs suggest continued growth, with a strong emphasis on technology and program administration. Event-gifting budgets are also expected to increase, reflecting confidence in the value of these programs for employee engagement.

This is one highlight of the Incentive Research Foundation 2025 Industry Outlook Study for Merchandise Gift Cards and Event Gifting study. It is based on 412 online interviews conducted in September and October of 2024 with industry professionals who manage or provide gift card and/or merchandise incentive programs and possess in-depth knowledge of non-cash incentive programs, including spend-related details. Responses were collected from North American and Europe (France, Germany, Italy, Spain, Sweden, and the United Kingdom.) According to the IRF, there was significant representation from corporate entities (organizations that use merchandise and/ or gift cards to engage, recognize, or thank employees, partners, customers, and event attendees) and third-party providers (agencies that offer merchandise and gift cards to support client programs). For the first time, the study incorporates input from channel programs (58% of responses) and employee programs (93% of responses), which the IRF feels adds a broader perspective to the analysis.

Among the key findings:

- The non-cash rewards landscape in 2025 is looking very promising, with a strong focus on long-term investment in reward programs across North America and Europe. Companies are increasingly aligning their rewards strategies with emerging trends in technology, sustainability, and personalization. This shift is expected to drive substantial growth in experiential and merchandise rewards, enhancing employee recognition and engagement.

-

Budget forecasts for non-cash rewards programs are on the rise, particularly in technology-driven solutions and enhanced administrative processes. This indicates a digital transformation in how rewards are managed and delivered. Companies are well-positioned to meet evolving employee expectations with personalized and scalable reward options.

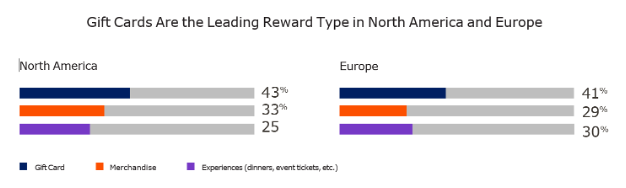

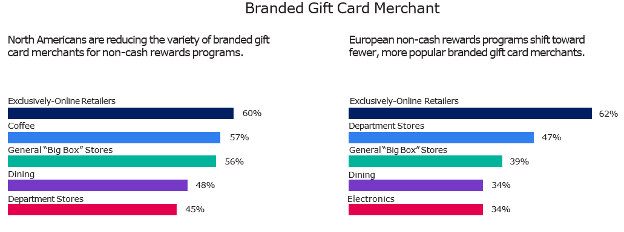

- Gift cards remain the leading incentive type, maintaining their popularity across North America and Europe. However, experiential rewards have gained significant traction, now matching merchandise in popularity in Europe. Program retention rates have improved significantly, indicating stability in the rewards market.

- In North America, the average annual spend per person on non-cash rewards has decreased, reflecting a shift towards more manageable incentive budgets. In contrast, Europe shows positive growth in non-cash rewards expenditures, with a preference for mid-to-high-value rewards.

- Merchandise spending trends differ between regions. North America has seen a decline in higher-value rewards, while Europe is experiencing an upward trend in merchandise spending, with a focus on higher-value items.

- Gift card denominations have decreased in North America but increased in Europe, reflecting a growing trend towards higher-value gift cards in Europe.

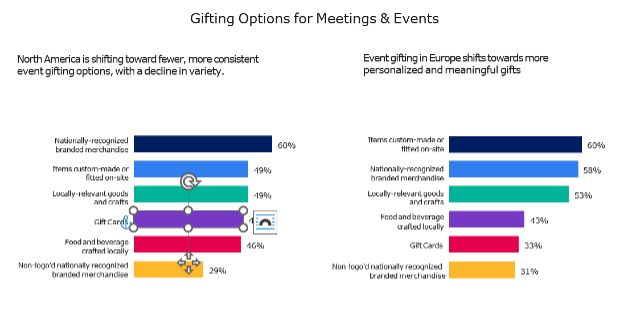

- Event gifting trends also vary, with North America showing a decline in spend and a focus on cost-effective options, while Europe emphasizes sustainability and personalization in event gifting.

- Overall, the design and implementation of incentive programs are heavily influenced by financial forecasts, internal stakeholders, and public perception. Both North America and Europe show optimism about their economic outlook and regulatory environment, which is expected to encourage further investment in non-cash rewards programs.

Here are other highlights of the study:

Enterprise Engagement Alliance Services

Celebrating our 15th year, the Enterprise Engagement Alliance helps organizations enhance performance through:

1. Information and marketing opportunities on stakeholder management and total rewards:

ESM Weekly on stakeholder management since 2009; click here for a media kit.

RRN Weekly on total rewards since 1996; click here for a EEA YouTube channel on enterprise engagement, human capital, and total rewards insights and how-to information since 2020.

2. Learning: Purpose Leadership and Stakeholder

Management Academy to enhance future equity value and performance for your organization.

Management Academy to enhance future equity value and performance for your organization.3. Books on implementation: Enterprise Engagement for CEOs and Enterprise Engagement: The Roadmap.

4. Advisory services and research: Strategic guidance, learning and certification on stakeholder management, measurement, metrics, and corporate sustainability reporting.

5. Permission-based targeted business development to identify and build relationships with the people most likely to buy.

6. Public speaking and meeting facilitation on stakeholder management. The world’s leading speakers on all aspects of stakeholder management across the enterprise.